IRAs vs. Roth IRAs 2026: Maximizing $7,000 Tax-Advantaged Savings

Anúncios

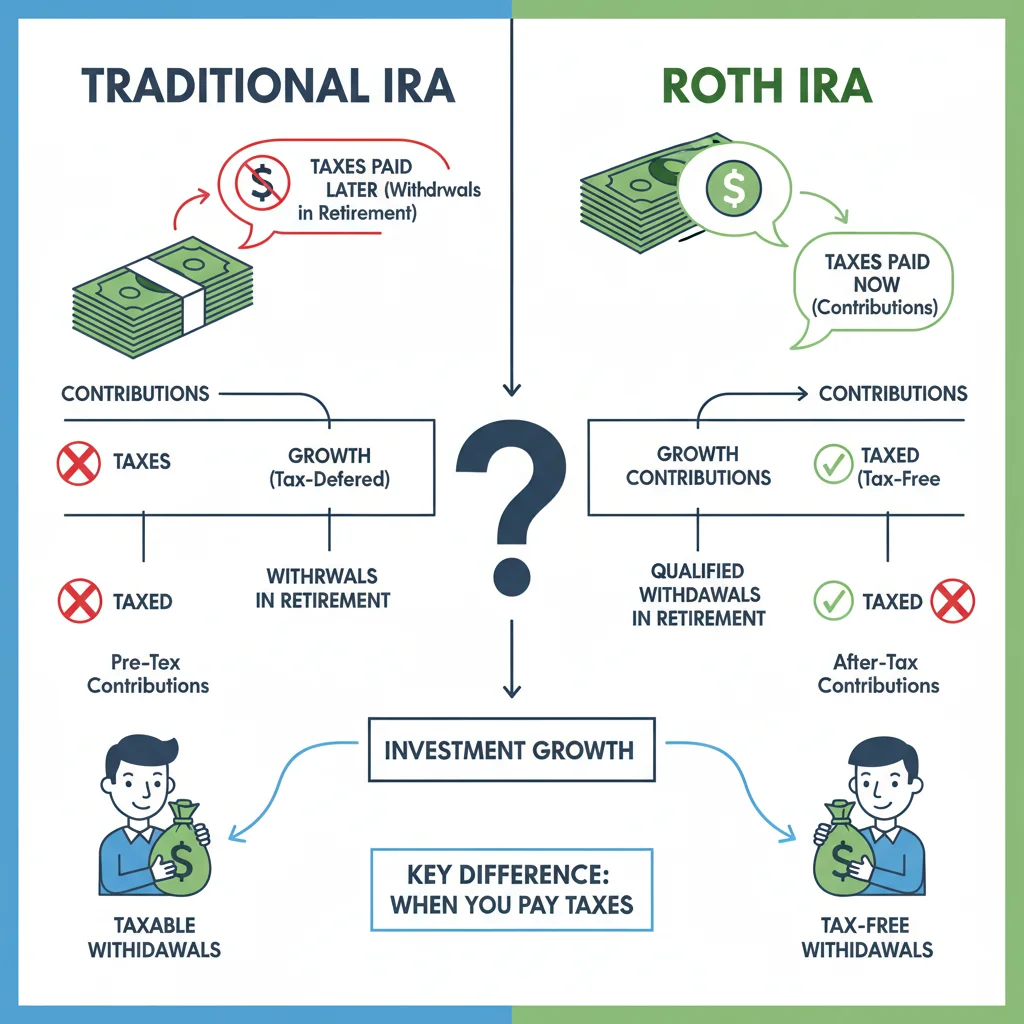

Understanding the distinctions between IRAs and Roth IRAs is essential for individuals seeking to maximize their $7,000 annual tax-advantaged savings for retirement in 2026, influencing both current and future tax liabilities.

Anúncios

Navigating the landscape of retirement savings can feel daunting, but understanding the core differences between IRAs vs Roth IRAs in 2026: A Comparative Analysis for Maximizing Tax-Advantaged Savings of $7,000 Annually is a critical first step. As we look towards 2026, the decisions you make today about where to allocate your retirement contributions will significantly impact your financial future. This article delves into the nuances of these popular retirement accounts, helping you make an informed choice to optimize your annual $7,000 contribution.

Understanding Traditional IRAs in 2026

Anúncios

Traditional Individual Retirement Arrangements (IRAs) have long been a cornerstone of retirement planning for many Americans. In 2026, the fundamental principles remain the same, offering a powerful way to save for retirement with potential upfront tax benefits. Contributions to a Traditional IRA are typically tax-deductible in the year they are made, meaning they can reduce your taxable income. This immediate tax break can be particularly appealing for individuals currently in a higher tax bracket, as it effectively lowers their current tax bill.

The magic of a Traditional IRA lies in its tax-deferred growth. Your investments grow over time without being subject to annual taxes on dividends, interest, or capital gains. This compounding effect allows your money to grow significantly faster than it would in a taxable account. However, the taxman eventually gets his due; withdrawals in retirement are generally taxed as ordinary income. The assumption here is that you might be in a lower tax bracket during retirement, making this tax deferral strategy advantageous.

Contribution Limits and Deductibility

For 2026, the contribution limit for Traditional IRAs is expected to be $7,000, with an additional catch-up contribution of $1,000 for those aged 50 and over. This allows older savers to contribute up to $8,000 annually. It’s important to remember that while anyone can contribute to a Traditional IRA, the deductibility of those contributions depends on whether you or your spouse are covered by a retirement plan at work and your Modified Adjusted Gross Income (MAGI).

- Full Deductibility: If you are not covered by a workplace retirement plan, your contributions are fully deductible regardless of your income.

- Partial or No Deductibility: If you are covered by a workplace plan, there are income phase-out ranges that determine how much of your contribution you can deduct.

- Spousal IRAs: Even if one spouse is covered by a workplace plan, the other spouse might still be able to deduct contributions to a Traditional IRA, depending on their combined income.

Understanding these limits and deductibility rules is crucial for maximizing the immediate tax benefits of a Traditional IRA. It’s not just about contributing, but about strategizing how those contributions impact your current tax situation.

In essence, a Traditional IRA offers a valuable tool for reducing current taxable income and allowing investments to grow tax-deferred. However, future tax obligations on withdrawals are a key consideration, making it essential to project your potential tax bracket in retirement.

Exploring Roth IRAs in 2026

Roth IRAs represent a different philosophy of tax-advantaged savings, offering tax-free withdrawals in retirement. This distinction makes them incredibly attractive, especially for younger individuals or those who anticipate being in a higher tax bracket during their retirement years. Unlike Traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning there’s no immediate tax deduction.

The primary benefit of a Roth IRA is the tax-free growth and withdrawals. Once your contributions have seasoned for at least five years and you are age 59½ or older, all qualified withdrawals, including earnings, are completely tax-free. This can be a significant advantage, as it provides a predictable income stream in retirement that is not subject to income tax, allowing for greater financial certainty.

Income Limitations and Contribution Methods

While the tax benefits of a Roth IRA are substantial, there are income limitations for direct contributions. For 2026, these income phase-out ranges are likely to be adjusted for inflation. If your MAGI exceeds these limits, you may not be able to contribute directly to a Roth IRA. However, there’s a popular strategy known as the ‘backdoor Roth IRA’ that allows high-income earners to still contribute to a Roth, by first contributing to a non-deductible Traditional IRA and then converting it to a Roth.

- Direct Contributions: Available to individuals and married couples whose MAGI falls below specified thresholds.

- Backdoor Roth: A strategy for high-income earners to bypass direct contribution limits by converting a non-deductible Traditional IRA to a Roth.

- Qualified Withdrawals: Tax-free and penalty-free withdrawals of earnings are permitted after age 59½ and the account has been open for at least five years.

The ability to withdraw funds tax-free in retirement provides immense flexibility and predictability. It also acts as a hedge against potentially rising tax rates in the future, a concern for many long-term financial planners. Understanding the income limits and alternative contribution methods is key to leveraging the power of a Roth IRA.

In summary, the Roth IRA offers a compelling proposition for those who prioritize tax-free growth and withdrawals in retirement, even if it means foregoing an upfront tax deduction. Its potential for providing tax-free income can be a game-changer for your financial independence.

Contribution Limits for 2026: A Closer Look

The annual contribution limits for IRAs and Roth IRAs are a critical component of retirement planning. For 2026, the IRS is expected to set the standard contribution limit at $7,000 for both Traditional and Roth IRAs. This figure represents the maximum amount an individual can contribute to these accounts combined in a single year, not per account. For instance, if you contribute $3,000 to a Traditional IRA, you can only contribute an additional $4,000 to a Roth IRA, for a total of $7,000.

For individuals aged 50 and older, an additional ‘catch-up’ contribution is permitted, which is projected to be $1,000 for 2026. This means those nearing retirement can contribute up to $8,000 annually. These limits are periodically adjusted for inflation, reflecting the rising cost of living and the need for greater retirement savings.

Impact of Adjusted Gross Income (AGI) on Contributions

While the base contribution limits apply to most, your Adjusted Gross Income (AGI) plays a significant role, particularly for Roth IRAs and the deductibility of Traditional IRA contributions. For Roth IRAs, if your AGI exceeds certain thresholds, your ability to make direct contributions will be phased out or eliminated entirely. These income limits are put in place to ensure that the tax-free benefits of Roth IRAs are primarily available to middle-income earners.

For Traditional IRAs, your AGI, in conjunction with whether you’re covered by a workplace retirement plan, determines the deductibility of your contributions. High-income earners with workplace plans may find their Traditional IRA contributions are not deductible, which can sometimes lead them to consider a backdoor Roth strategy. It’s crucial to consult the latest IRS guidelines for 2026 to understand the precise income phase-out ranges.

- Standard Limit: $7,000 for individuals under 50.

- Catch-Up Limit: Additional $1,000 for those 50 and over (total $8,000).

- Roth AGI Limits: Phase-out ranges apply for direct contributions.

- Traditional Deductibility: Depends on AGI and workplace plan coverage.

Staying informed about these limits and how your income affects your eligibility is paramount for effective retirement planning. Maximizing your annual $7,000 contribution, or $8,000 if eligible for catch-up, is a powerful step towards a secure financial future.

Tax Advantages: Pre-tax vs. Post-tax

The fundamental distinction between Traditional and Roth IRAs lies in their tax treatment: pre-tax vs. post-tax contributions. This choice dictates when you receive your tax break and ultimately how your withdrawals are taxed in retirement. Understanding this core difference is key to aligning your retirement strategy with your current and projected future tax situation.

With a Traditional IRA, contributions are typically made with pre-tax dollars. This means that the money you contribute reduces your taxable income in the year you make the contribution, potentially lowering your current tax bill. The growth of your investments within the Traditional IRA is tax-deferred until retirement, at which point withdrawals are taxed as ordinary income. This strategy is often favored by those who expect to be in a lower tax bracket during retirement than they are in their working years.

Roth IRA: Tax-Free Growth and Withdrawals

Conversely, a Roth IRA operates on a post-tax contribution model. You contribute money that has already been taxed, meaning there’s no immediate tax deduction. However, the significant advantage here is that all qualified withdrawals in retirement, including all earnings, are completely tax-free. This offers immense peace of mind, as you know exactly how much you’ll receive from your Roth IRA without worrying about future tax liabilities.

The decision between pre-tax and post-tax hinges on your tax bracket today versus your anticipated tax bracket in retirement. If you believe your taxes will be higher in retirement (perhaps due to increased income from other sources or rising tax rates), a Roth IRA’s tax-free withdrawals are highly advantageous. If you expect to be in a lower tax bracket, the upfront deduction of a Traditional IRA might be more appealing.

- Traditional IRA: Upfront tax deduction, tax-deferred growth, taxed withdrawals in retirement.

- Roth IRA: No upfront deduction, tax-free growth, tax-free withdrawals in retirement.

- Tax Bracket Forecasting: Crucial for choosing the most beneficial tax treatment.

Ultimately, both account types offer significant tax advantages over standard taxable investment accounts. The choice between them is a strategic one, tailored to your individual financial circumstances and future expectations regarding tax rates.

Withdrawal Rules and Considerations

The rules surrounding withdrawals from Traditional and Roth IRAs are distinct and can significantly impact your retirement income strategy. Understanding these rules is crucial to avoid penalties and maximize the benefits of your chosen account type.

For Traditional IRAs, withdrawals made before age 59½ are generally subject to a 10% early withdrawal penalty, in addition to being taxed as ordinary income. There are a few exceptions to this rule, such as for qualified higher education expenses, first-time home purchases (up to $10,000), or if you become totally and permanently disabled. Once you reach age 59½, withdrawals are taxed as ordinary income, but there’s no penalty. Furthermore, Traditional IRAs are subject to Required Minimum Distributions (RMDs) starting at a certain age (currently 73 for most individuals in 2026), meaning you must begin withdrawing a minimum amount each year whether you need the money or not.

Roth IRA Withdrawal Flexibility

Roth IRAs offer much greater flexibility regarding withdrawals. Contributions can be withdrawn at any time, tax-free and penalty-free, regardless of your age or how long the account has been open. This makes Roth IRAs an excellent emergency fund alternative or a flexible savings vehicle. For earnings, qualified withdrawals are both tax-free and penalty-free, provided the account has been open for at least five years and you are age 59½ or older, become disabled, or use the funds for a first-time home purchase (up to $10,000).

- Traditional IRA: Penalties for early withdrawals, RMDs apply in retirement, withdrawals taxed as income.

- Roth IRA: Contributions can be withdrawn anytime tax-free/penalty-free; qualified earnings withdrawals are also tax-free/penalty-free; no RMDs for the original owner.

- Estate Planning: The absence of RMDs for Roth IRA owners makes them attractive for leaving tax-free inheritances.

The absence of RMDs for Roth IRA owners is a significant advantage, particularly for estate planning, as it allows your money to continue growing tax-free for your beneficiaries. The flexibility and tax-free nature of Roth withdrawals make them a powerful tool for retirement income and financial planning.

Who Benefits More: Traditional vs. Roth?

Deciding between a Traditional IRA and a Roth IRA, or even utilizing both, largely depends on your current financial situation, your income trajectory, and your expectations for future tax rates. There isn’t a one-size-fits-all answer, and what works best for one individual might not be ideal for another.

A Traditional IRA tends to be more beneficial for individuals who anticipate being in a lower tax bracket during retirement than they are in their working years. The immediate tax deduction can provide significant savings now, and the tax-deferred growth allows your investments to compound over time. This is often the case for those with higher incomes in their prime earning years who expect a more modest income in retirement, or for those who are seeking to reduce their current taxable income.

Ideal Scenarios for Each Account Type

The Roth IRA, with its tax-free withdrawals in retirement, is often ideal for younger investors who are currently in lower tax brackets. By paying taxes on their contributions now, they can enjoy tax-free income during their potentially higher-earning retirement years. It’s also an excellent choice for those who anticipate rising tax rates in the future, as it locks in the tax treatment of their contributions today. Furthermore, the flexibility of Roth withdrawals and the absence of RMDs make it attractive for those who may want to leave a tax-free inheritance or simply have more control over their retirement distributions.

Many financial advisors advocate for a diversified approach, contributing to both a Traditional and a Roth IRA if eligible. This strategy, often called ‘tax diversification,’ allows you to hedge against uncertainty in future tax rates. By having both pre-tax and post-tax retirement income streams, you gain flexibility to choose which accounts to draw from based on the prevailing tax environment in retirement, potentially optimizing your overall tax liability.

- Traditional IRA: Best for those expecting lower tax brackets in retirement.

- Roth IRA: Ideal for younger earners, those expecting higher tax brackets in retirement, or anticipating rising future tax rates.

- Hybrid Approach: Combining both for tax diversification and flexibility.

Ultimately, the choice should be an informed one, considering your current income, future income projections, and personal financial goals. Reviewing your situation annually can help you adjust your strategy as life circumstances and tax laws evolve.

Maximizing Your $7,000 Annual Savings in 2026

With the 2026 contribution limit for IRAs and Roth IRAs set at $7,000 (or $8,000 for those 50 and over), strategic planning is essential to make the most of these tax-advantaged savings opportunities. Simply contributing the maximum isn’t enough; understanding how to allocate those funds effectively can significantly enhance your retirement security.

One of the first steps in maximizing your $7,000 annual savings is to assess your current and projected future tax situation. If you are currently in a high tax bracket and expect to be in a lower one during retirement, prioritizing a Traditional IRA for its upfront tax deduction might be the most beneficial. This immediate tax savings can then be reinvested or used to bolster other financial goals. Conversely, if you are in a lower tax bracket now and anticipate higher income or tax rates in retirement, funneling your contributions into a Roth IRA will ensure tax-free withdrawals when you need them most.

Strategic Allocation and Future Planning

Consider diversifying your retirement savings by contributing to both a Traditional and a Roth IRA, if your income allows. This ‘tax diversification’ strategy provides flexibility in retirement. You can choose to withdraw from your Traditional IRA in years when your tax bracket is low and from your Roth IRA in years when it’s high, effectively managing your tax burden throughout retirement. This approach also acts as a hedge against unpredictable future tax policy changes.

- Assess Tax Brackets: Evaluate current vs. projected retirement tax rates.

- Utilize Catch-Up: For those 50+, take advantage of the additional $1,000 contribution.

- Consider Backdoor Roth: If income limits prevent direct Roth contributions.

- Automate Contributions: Set up automatic transfers to ensure consistent savings.

Don’t forget the power of compounding. By consistently contributing the maximum $7,000 (or $8,000) each year, you allow your investments more time to grow significantly. Even small, consistent contributions can lead to substantial wealth accumulation over decades. Regular review of your retirement plan with a financial advisor can also help ensure you’re on track to meet your goals and adapt to any changes in your financial situation or tax laws. Maximizing your annual contributions is a proactive step towards a comfortable and secure retirement.

| Key Feature | Description |

|---|---|

| Contribution Limit 2026 | $7,000 ($8,000 for age 50+) for both Traditional and Roth IRAs combined. |

| Traditional IRA Tax | Pre-tax contributions (deductible), tax-deferred growth, withdrawals taxed in retirement. |

| Roth IRA Tax | Post-tax contributions (non-deductible), tax-free growth, tax-free withdrawals in retirement. |

| Withdrawal Flexibility | Roth offers more flexibility with tax-free contributions withdrawal and no RMDs for owners. |

Frequently Asked Questions About IRAs and Roth IRAs

The primary distinction lies in their tax treatment. Traditional IRA contributions are often tax-deductible, with withdrawals taxed in retirement. Roth IRA contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free.

For 2026, the combined contribution limit for Traditional and Roth IRAs is $7,000. If you are age 50 or older, you can make an additional catch-up contribution of $1,000, bringing your total to $8,000.

Yes, direct contributions to a Roth IRA are subject to income phase-out ranges based on your Modified Adjusted Gross Income (MAGI). If your income exceeds these limits, you might need to explore a backdoor Roth conversion strategy.

Yes, you can hold both a Traditional and a Roth IRA. However, your total contributions to both accounts combined cannot exceed the annual limit ($7,000 or $8,000 if 50+).

For Traditional IRAs, penalty-free withdrawals typically begin at age 59½. For Roth IRAs, contributions can be withdrawn anytime tax-free and penalty-free. Qualified earnings withdrawals from Roth IRAs are also tax-free after age 59½ and a five-year seasoning period.

Conclusion

Choosing between a Traditional IRA and a Roth IRA, or strategically incorporating both, is a pivotal decision in your long-term financial planning. As we approach 2026, understanding the nuances of their tax treatments, contribution limits, and withdrawal rules is paramount for maximizing your annual $7,000 tax-advantaged savings. Your personal income, anticipated future tax bracket, and retirement goals should guide your choice. By making an informed decision, you can effectively leverage these powerful retirement vehicles to build a secure and prosperous financial future, ensuring your hard-earned money works as efficiently as possible for you.