Personal Loan Rates 2026: Secure Below 7.99% APR

Anúncios

Securing a personal loan rate below 7.99% APR in 2026 demands a proactive approach, including optimizing your credit score, thoroughly comparing lender offers, and understanding prevailing economic conditions.

Anúncios

As we look towards 2026, the landscape of personal finance continues to evolve, making it crucial for consumers to understand how to navigate the market effectively. For those seeking capital, understanding personal loan rates in 2026 and how to secure terms below 7.99% APR is not just an advantage, but a necessity for smart financial planning. This guide will equip you with the knowledge and strategies to achieve your financial goals with favorable loan conditions.

Understanding the Personal Loan Market in 2026

The personal loan market in 2026 is shaped by various macroeconomic factors, including inflation, Federal Reserve policies, and global economic stability. These elements directly influence the interest rates lenders offer to consumers. Staying informed about these broader trends is the first step in positioning yourself for the best possible loan terms.

Anúncios

In the current environment, lenders are becoming more sophisticated in their risk assessments, utilizing advanced algorithms and data analytics to determine eligibility and rates. This means that a comprehensive understanding of your own financial profile is more important than ever. Being prepared will allow you to confidently approach lenders and negotiate from a position of strength.

Key Economic Indicators to Watch

Several economic indicators will play a pivotal role in shaping personal loan rates in 2026. The Federal Funds Rate, set by the Federal Reserve, typically serves as a benchmark for other lending rates. When this rate increases, personal loan rates tend to follow suit, making it harder to secure lower APRs. Conversely, a decrease often leads to more favorable borrowing conditions.

- Inflation Rates: High inflation often prompts central banks to raise interest rates to cool down the economy, impacting loan costs.

- Unemployment Data: A strong job market generally indicates economic health, which can lead to more competitive loan offerings.

- Consumer Confidence: High consumer confidence can boost borrowing and spending, influencing lender strategies and rate adjustments.

Monitoring these indicators will provide valuable foresight into potential shifts in the personal loan market. This proactive approach allows you to time your loan application strategically, aligning with periods when rates are more likely to be lower. Understanding these dynamics is crucial for anyone aiming to secure personal loan rates below 7.99% APR.

The personal loan market in 2026 is characterized by increased competition among lenders, driven by technological advancements and evolving consumer demands. This competition can work in your favor, as lenders strive to attract borrowers with more appealing rates and flexible terms. However, it also means that borrowers must be diligent in their research and comparisons to find the truly best offers.

The Pivotal Role of Your Credit Score

Your credit score remains the single most influential factor in determining the personal loan rates you qualify for. Lenders use this three-digit number to assess your creditworthiness and the likelihood of you repaying your debt. A higher credit score signals a lower risk to lenders, translating into more attractive interest rates and better loan terms, potentially well below the 7.99% APR target.

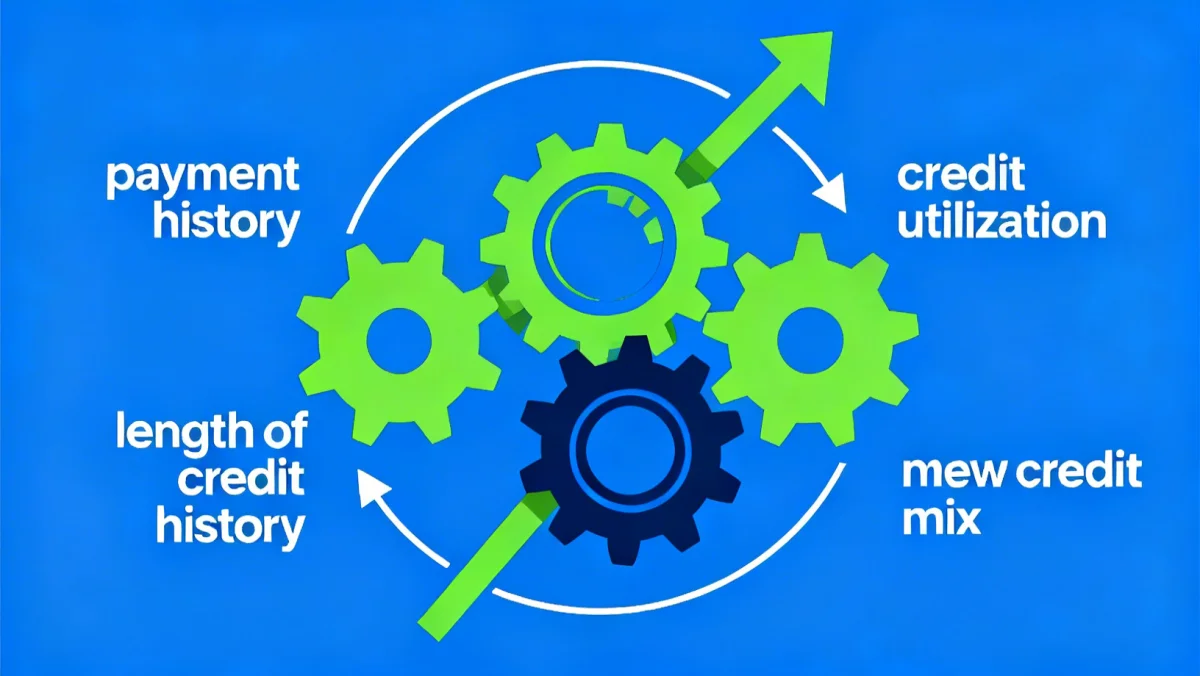

Building and maintaining an excellent credit score requires consistent effort and responsible financial habits. This includes paying bills on time, keeping credit utilization low, and avoiding excessive new credit applications. Understanding how your credit score is calculated and what factors impact it most can empower you to make informed decisions.

How to Improve Your Credit Score

Improving your credit score is a long-term endeavor, but even small changes can yield significant results over time. Start by obtaining a copy of your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) and review them for any errors. Disputing inaccuracies can quickly boost your score.

- Payment History: Consistently making on-time payments is the most critical factor. Even one late payment can significantly damage your score.

- Credit Utilization: Aim to keep your credit card balances below 30% of your available credit. Lower utilization indicates responsible credit management.

- Length of Credit History: A longer credit history generally bodes well for your score, as it provides lenders with more data to assess your reliability.

- Credit Mix: Having a mix of different credit types (e.g., credit cards, installment loans) can positively impact your score.

- New Credit: Avoid opening too many new credit accounts in a short period, as this can signal higher risk to lenders.

For those targeting personal loan rates below 7.99% APR in 2026, a credit score in the excellent range (typically 760 and above) will significantly enhance your chances. Lenders reserve their lowest rates for borrowers with the strongest credit profiles, as they pose the least risk of default. Focus on these credit-building strategies well in advance of your loan application.

Even if your credit score isn’t perfect, there are still steps you can take. Consider secured personal loans or co-signed loans, which can offer better rates than unsecured options for those with less-than-stellar credit. However, the ultimate goal should be to improve your credit score to unlock the most competitive rates available.

Comparing Lender Types and Offers

The personal loan market in 2026 is diverse, with various types of lenders offering different products and rates. Understanding these distinctions is crucial for finding the best terms. Traditional banks, credit unions, and online lenders each have unique advantages and disadvantages that can impact your ability to secure a loan below 7.99% APR.

Never settle for the first offer you receive. Diligent comparison shopping is paramount. Utilize online comparison tools, read reviews, and directly contact multiple lenders to gather a range of quotes. Pay close attention not only to the APR but also to fees, repayment terms, and customer service quality.

Online Lenders vs. Traditional Institutions

Online Lenders: These platforms often boast streamlined application processes and quicker funding times. Many online lenders specialize in offering competitive rates to borrowers with strong credit, making them a prime target for those aiming for sub-7.99% APR. Their lower overhead costs can sometimes translate into better rates for consumers.

Traditional Banks: Established banks may offer a sense of security and personalized service, especially if you have an existing relationship with them. While their application processes can be more involved, they might offer loyalty discounts or special rates to long-standing customers. It’s always worth checking with your primary bank.

Credit Unions: Often member-owned, credit unions are known for their community focus and typically offer more personalized service. They often have lower interest rates and more flexible terms compared to traditional banks, as their primary goal is to serve their members rather than maximize profits. Membership requirements usually apply, but they are often easy to meet.

When comparing offers, it’s essential to look beyond the advertised annual percentage rate (APR). Scrutinize the fine print for origination fees, late payment penalties, and prepayment penalties. A seemingly low APR could be offset by high fees, ultimately increasing the total cost of your loan. Utilize online calculators to compare the total cost of different loan offers over their full terms.

The key to securing the best personal loan rates in 2026, especially those below 7.99% APR, lies in thorough research and direct comparison. Don’t be afraid to leverage offers from one lender to negotiate a better deal with another. The competitive landscape works in favor of informed borrowers.

Strategies for Lowering Your APR

Beyond a strong credit score and diligent comparison shopping, several strategies can help you further reduce your personal loan APR. These tactics often involve demonstrating a lower risk profile to lenders or leveraging specific features that can lead to discounts. Every fraction of a percentage point saved can translate into significant savings over the life of the loan.

One effective strategy is to consider a shorter loan term. While this means higher monthly payments, it often results in a lower overall interest paid and a more attractive APR. Lenders perceive shorter terms as less risky, as there’s less time for economic conditions or your financial situation to deteriorate.

Leveraging Co-signers and Collateral

Co-signer: If your credit score is good but not excellent, or if you have a limited credit history, adding a co-signer with strong credit can significantly lower your APR. A co-signer shares the responsibility for the loan, reducing the lender’s risk and making them more willing to offer a better rate. Ensure both parties understand the implications of co-signing.

Collateral: For those who own valuable assets, a secured personal loan might be an option. By offering collateral such as a vehicle, savings account, or real estate, you provide the lender with security in case of default. This reduces their risk and can lead to substantially lower interest rates, often making it easier to achieve an APR below 7.99%.

- Autopay Discounts: Many lenders offer a small interest rate discount (e.g., 0.25% to 0.50%) if you enroll in automatic payments. This guarantees on-time payments, which benefits both you and the lender.

- Existing Customer Discounts: If you’re applying for a loan with a bank or credit union where you already have an account, inquire about any loyalty discounts they might offer.

- Debt-to-Income Ratio: A low debt-to-income (DTI) ratio indicates that you have ample disposable income to cover new loan payments. Lenders view a lower DTI favorably, which can positively influence your offered APR.

Carefully evaluating these strategies can provide you with additional leverage when negotiating personal loan rates in 2026. The goal is to present yourself as the least risky borrower possible, thereby unlocking the most competitive terms available. Don’t overlook these opportunities to secure an APR below 7.99%.

Remember that transparency with your financial situation and clear communication with lenders can also pave the way for better terms. Be ready to explain any past financial challenges and outline your plan for responsible repayment.

Understanding APR vs. Interest Rate

While often used interchangeably, the Annual Percentage Rate (APR) and the interest rate are distinct concepts crucial for understanding the true cost of a personal loan. Grasping this difference is fundamental when striving to secure personal loan rates below 7.99% APR in 2026, as the APR provides a more complete picture of your borrowing costs.

The interest rate is simply the cost of borrowing money, expressed as a percentage of the principal. It’s the core charge for using the lender’s funds. However, the APR encompasses more than just the interest rate; it includes other fees and charges associated with the loan, annualized over the loan term. This makes APR a more comprehensive measure of a loan’s total cost.

Why APR is the Key Metric

When comparing personal loan offers, always focus on the APR. It allows for an apples-to-apples comparison between different lenders, even if they have varying fee structures. A loan with a lower interest rate but high origination fees might end up having a higher APR than a loan with a slightly higher interest rate but no fees.

For instance, if a lender advertises a 6.5% interest rate but charges a 2% origination fee, your effective APR will be higher than 6.5%. Conversely, a lender offering a 7.0% interest rate with no fees might actually be a cheaper option. The 7.99% target for personal loan rates in 2026 specifically refers to the APR, emphasizing the importance of this metric.

Understanding the components that make up the APR is also valuable. These typically include:

- Interest Rate: The base cost of borrowing.

- Origination Fees: A one-time fee charged by the lender for processing the loan.

- Application Fees: Sometimes charged for submitting your loan application.

- Underwriting Fees: Costs associated with assessing your creditworthiness.

Not all loans will have all these fees, and some lenders may waive certain charges, especially for highly qualified borrowers. Always ask for a detailed breakdown of all costs included in the APR. This transparency will help you accurately compare offers and ensure you’re truly getting a rate below 7.99% in 2026.

By focusing on the APR, you can avoid hidden costs and make a more informed decision about which personal loan is truly the most affordable. This understanding is critical for effective financial planning and securing optimal terms.

Post-Approval Steps and Ongoing Management

Securing a personal loan below 7.99% APR in 2026 is a significant achievement, but the process doesn’t end there. Responsible post-approval management is essential to maintain your financial health and ensure you fully benefit from the favorable terms you’ve secured. This involves consistent payment, understanding your loan agreement, and being prepared for future financial planning.

Once your loan is approved, carefully review the final loan documents. Ensure that all terms, including the APR, repayment schedule, and any fees, match what you agreed upon. Understanding every clause will prevent future surprises and help you manage your loan effectively.

Effective Loan Repayment Strategies

Establishing a clear repayment strategy from the outset is crucial. Most lenders offer various payment options, including automatic deductions from your bank account. Enrolling in autopay not only ensures on-time payments but can also sometimes qualify you for a small interest rate discount, further reducing your overall cost.

- Automate Payments: Set up automatic transfers to avoid missing payment due dates, which can incur late fees and negatively impact your credit score.

- Budgeting: Incorporate your loan payments into your monthly budget to ensure you have sufficient funds available. Adjust other spending as needed.

- Extra Payments: If your budget allows, consider making extra payments or paying more than the minimum required. This can reduce the principal faster, thereby cutting down the total interest paid over the loan term.

- Monitor Your Credit: Regularly check your credit report to ensure your payments are being reported accurately and to spot any potential issues early.

Maintaining a strong payment history for your personal loan will positively impact your credit score, making it easier to secure favorable terms for future borrowing needs. This responsible behavior reinforces your creditworthiness and keeps you in a strong financial position.

Should your financial situation change, don’t hesitate to contact your lender. Many lenders are willing to work with borrowers who are experiencing temporary hardship, potentially offering options like deferment or modified payment plans. Proactive communication is always better than missing payments without notice.

Future Trends and Considerations for 2026

Looking ahead to 2026, several emerging trends and considerations could further influence personal loan rates and the borrowing landscape. Staying informed about these developments will be key for consumers aiming to secure and maintain optimal loan terms. The financial ecosystem is dynamic, and adaptation is crucial for success.

Technological advancements, particularly in AI and machine learning, are set to refine how lenders assess risk and offer personalized products. This could lead to even more tailored loan offers, potentially benefiting borrowers with unique financial profiles who might not fit traditional lending criteria.

The Rise of Fintech and Personalized Lending

The continued growth of financial technology (fintech) companies is expected to drive innovation in the personal loan space. These companies often leverage cutting-edge technology to offer faster approvals, more flexible terms, and sometimes more competitive rates than traditional institutions. Their focus on user experience also makes the application process more intuitive.

Personalized lending, driven by big data analytics, will become more prevalent. Lenders will increasingly use a broader range of data points—beyond just credit scores—to evaluate applicants. This could include banking behavior, employment history, and even educational background, leading to more nuanced risk assessments and potentially more inclusive lending.

- Blockchain Technology: While still nascent in personal lending, blockchain could introduce greater transparency and security to loan transactions, potentially reducing costs and improving efficiency.

- ESG Factors: Environmental, Social, and Governance (ESG) considerations might begin to influence lending decisions, with some lenders offering preferential rates to borrowers who align with certain sustainability goals or ethical practices.

- Regulatory Changes: Potential changes in financial regulations could impact how lenders operate and the rates they can charge. Staying updated on legislative developments is always wise.

For borrowers targeting personal loan rates below 7.99% APR in 2026, embracing these trends means being open to exploring new lending platforms and understanding how a more holistic view of your financial health can work in your favor. Preparing a comprehensive financial narrative, rather than just relying on your credit score, could become increasingly important.

The future of personal lending in 2026 promises both opportunities and challenges. By remaining informed, adaptable, and proactive, you can position yourself to take advantage of the evolving market and continue to secure the most favorable loan terms for your needs.

| Key Point | Brief Description |

|---|---|

| Credit Score Impact | An excellent credit score (760+) is crucial for securing the lowest personal loan rates. |

| Lender Comparison | Compare offers from banks, credit unions, and online lenders to find the best APR. |

| APR vs. Interest Rate | Focus on APR, as it includes all loan costs, providing a true comparison of expenses. |

| Rate Reduction Strategies | Consider co-signers, collateral, or autopay discounts to further lower your APR. |

Frequently Asked Questions About Personal Loan Rates in 2026

To secure a personal loan below 7.99% APR in 2026, an excellent credit score, typically 760 or higher, is generally recommended. Lenders reserve their most competitive rates for borrowers who demonstrate the lowest risk of default, making a strong credit profile essential for favorable terms.

Economic factors like the Federal Funds Rate, inflation, and unemployment significantly influence personal loan rates. When the Federal Reserve raises rates or inflation is high, loan rates generally increase. A strong economy with low unemployment often leads to more competitive loan offers from lenders.

The best option depends on your individual needs. Online lenders often offer quick approvals and competitive rates. Credit unions typically provide lower rates and more personalized service to members. Traditional banks may offer loyalty discounts. Comparing offers from all types is crucial to find the best terms.

Yes, adding a co-signer with excellent credit can significantly improve your chances of securing a lower APR, potentially below 7.99%. A co-signer reduces the lender’s risk, as they are equally responsible for repayment. This strategy is particularly useful if your credit history is limited or not yet optimal.

When taking out a personal loan, be aware of origination fees, application fees, and prepayment penalties. These fees can increase the overall cost of your loan, even if the interest rate seems low. Always focus on the Annual Percentage Rate (APR) as it includes most of these additional charges for a true cost comparison.

Conclusion

Navigating the personal loan market in 2026 to secure rates below 7.99% APR requires a strategic and informed approach. By prioritizing credit score improvement, diligently comparing lender offers, understanding the nuances between APR and interest rates, and leveraging available strategies like co-signers or collateral, borrowers can significantly enhance their chances of obtaining favorable terms. Staying abreast of economic trends and embracing new financial technologies will also be crucial for success in a dynamic lending landscape. Ultimately, proactive financial management and thorough research are your strongest allies in achieving your borrowing goals.